Invest extra Rs 50,000 more in your PPF account now

4.8 (65) · € 18.50 · En Stock

Now you can deposit extra Rs 50,000 in your PPF account as the limit for ppf investments has raised from Rs 1 lac per year to Rs 1.5 lacs in this budget.

Invest extra Rs 50,000 more in your PPF account now

What is the Public Provident Fund (PPF) Scheme?

PPF (Public Provident Fund) Accounts Offer 7.6% Interest But There's More You Might Not Know

15 Tax Saving Options Other Than Section 80C

What is the best return of investment if you have 50k rupees in India? - Quora

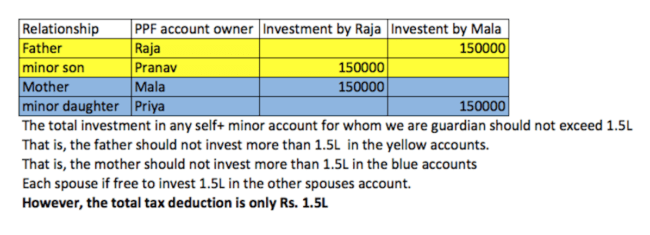

How much can we invest in multiple PPF accounts?

PPF Investment and Deposit Rules - Beware your Banks are unaware of it! - BasuNivesh

Should I invest 150,000 as a lump sum or slowly within a year, in a PPF account? - Quora

Public Provident Fund: 5 facts you must know about PPF

Investment Plans : 19 Best Investment Plans for High Long Term Returns in 2024

Why doesn't the government increase the cap on PPF yearly deposit from Rs 1, 50,000? - Quora

NPS Tax Benefits - Sec.80CCD(1), 80CCD(2) and 80CCD(1B) - BasuNivesh

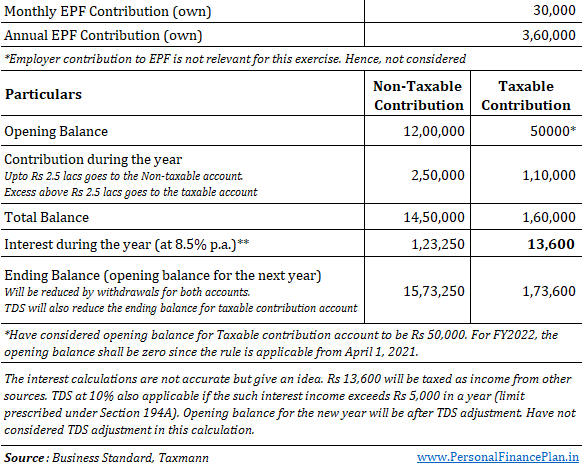

EPF Tax: How will your EPF contribution above Rs 2.5 lacs be taxed?

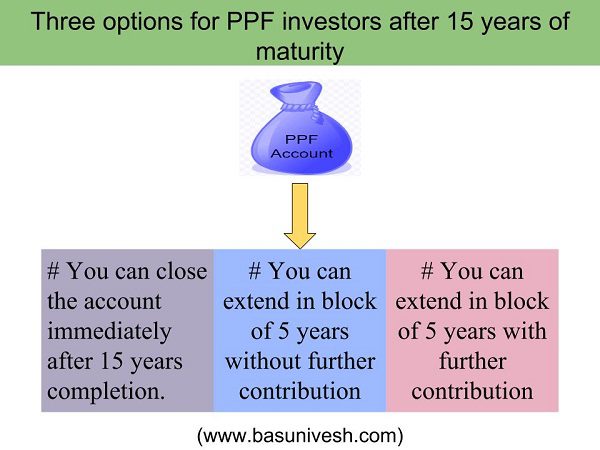

PPF Interest Rate 2023, Tax Benefits & Withdrawal Rules.